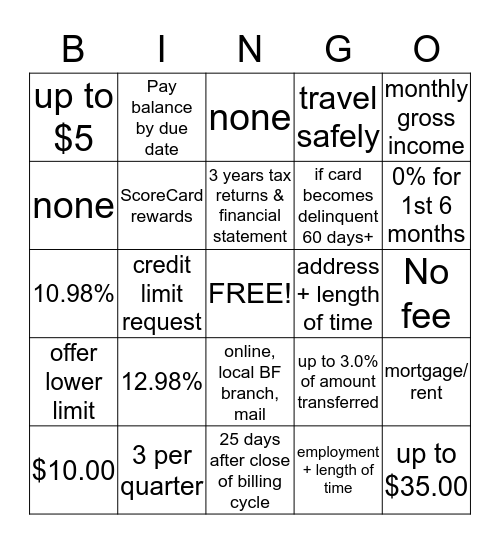

credit card length of time

The length of your credit history begins when you open your first credit card or take out your first loan. The ages of credit historyof these accounts are 1 year 10 years 8 years 5 years 5years 2 years and 3 years.

Chime Credit Builder A New Way To Build Credit

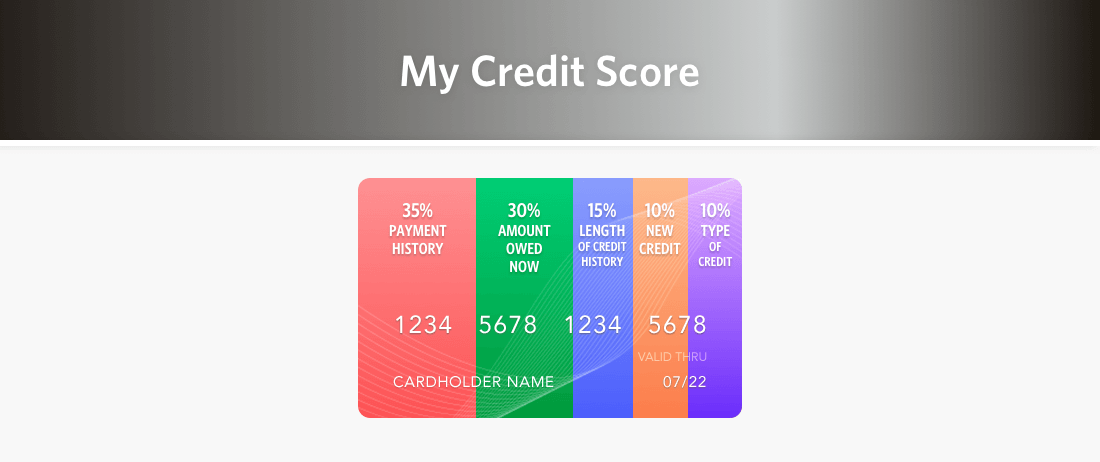

In a FICO Score High Achievers study people with a FICO Score ranging from 800-850 had an average length of credit history of 99-128 months around 8-11 years.

. Divide this by seven total. Your credit history will grow with age and as you open new accounts. I think you are right on the Card Act language on waiting 12 months to upgrade to a higher AF card in a group.

Where people get confused is regarding the amount of time you have to dispute. I dont think that means AAOA cause right now my AAOA is at about 33years and thats after I app spreed and picked up 4 new cards end of Sept. If you miss even one payment on your credit card here are four terrible horrible no good very bad results you may face.

A longer credit history will always have. Your credit score can drop more than 100 points. While age-related factors can impact your credit scores.

In the meantime use the card to the max and if. So my husband has a Helzberg Diamonds credit card Comenity Bank with a 1000 credit limit. The length of your billing cycle varies from issuer to issuer and may range from 27.

A credit card billing cycle is simply the time period between billing statements. Typically the longer a person has had credit the higher their credit score will be granted they dont have a history of late payments maxed-out balances or other negative. One of the valuable benefits of using a credit card is the ability to dispute credit card charges.

However if you need a loan or see a great credit card offer dont let length of credit history keep you from applying. 500 1000 Average credit card approval rating for. Even some people who havent had credit for a considerable length of time can still have a high FICO Score if the rest of their credit report looks good.

The number of new credit. 30 days or less Average first-time credit limit. Average length of time it takes to get approved for a credit card.

It would take more than 26 years to pay off a 10000 credit card balance if you only paid the minimum assuming an interest rate of 15. 7 hours agoWhen looking for a 0 APR credit card the length of the introductory offer is one of the most important factors to consider. Adam McCann Financial Writer.

We bought some jewelry paid it off over the course of several months never missing a. Adding up these ages leaves you with 34 years.

Credit Debt Vocabulary Crossword Wordmint

Pilot Gas Customer Upset About 151 Hold On Credit Card When Buying Gas Money Matters Cleveland Com

Understanding Your Credit Score Ppt Download

How Long Does It Take To Get A Credit Card Bankrate

Business In A Box Ltd Looking To Improve Your Credit Score We Have Some Tips For You Increase The Length Of Your Credit History The Longer You Have A Credit Account

Is It Better To Cancel A Unused Credit Card Or Keep It And Let It Expire Quora

Best 0 Intro Apr Credit Cards For October 2022

How To Get 100 Approved For Credit Card 5 Best Offers For Any Credit

How Often Should I Use My Credit Card Credit Cards U S News

Parts Library 85 56 Credit Card Sized Standard Pcb Template Dangerous Prototypes

How Long Do Credit Card Companies Keep Records Of Purchases

How Long Should I Wait Between Credit Card Applications Nerdwallet

How Long Should I Wait Between Credit Card Applications Bankrate

Can You Raise Your Credit Score By 100 Points In 30 Days